Online Entertainment Media Startups in Myanmar - A closer look

Opportunities and challenges

[Disclaimer] I am a co-founder of Momolay, one of the fastest growing online entertainment media in Myanmar. This piece focuses on news media startups in the entertainment field without consideration for business, political and other fields.

A closer look is a series of long-form expository pieces on current trends and issues surrounding Myanmar Startup Scene.

The Enablers

Before 2010, Myanmar had one of the highest SIM prices in the world at $1,840 US (1,500,000 Kyats) per card1. This prohibited the widespread use of mobile phones in Myanmar. However, after the price was cut to US$6252 and again to $250 in 2011, the major change came in 2013 when the price was eventually cut by 99% to US$1.75 (1,500 Kyats)3.

In 2014, two international telecom providers - Norway-based Telenor and Qatar's Ooredoo, were granted licenses for an initial duration of 15 years4, ending state-owned Myanmar Post and Telecommunications (MPT)'s monopoly. MPT responded by partnering with Japanese carrier KDDI and trading house Sumitomo5. The ensuing competition among telecom operators resulted in the lowering of call and data prices and improvement of overall service quality over the next few years.

Around the same time, mobile phone makers entered Myanmar to cater to the burgeoning mobile phone market. Huawei led the pack by capturing more than 50% market share in 20156 with its low-cost smartphones.

Falling call and data prices, coupled with availability of low-cost smartphones, enabled the rapid mobile phone penetration, which increased from 30 millions (56%) in 20157 to 53.98 millions (101%) in 20188. In tandem, internet penetration increased more than threefold from 5 millions (9% of the population) to 18 millions (34%).

In 2016, Facebook's controversial Free Basics, which allowed people to connect for free to Facebook site and a selected mobile sites9, drove more people online. Active Facebook users subsequently grew from 7.3 millions in 2015 to 18 millions in 2018. A convergence of factors, including a lack of prior exposure to the internet and the rapid embrance of social media made Facebook synonymous with the internet among Myanmar users.

The Rise of Online Entertainment Media

As mobile internet penetration explodes and popularity of Facebook soars, a host of new entertainment media have appeared on Facebook to cater the entertainment-hungry youth.

A few of the earliest to appear on Facebook were Myanmar Celebrity and Yoyarlay which started in 2010 and 2011 respectively. They were followed by other media startups such as Photutaw in 2013 and Momolay in 2015. Momolay subsequently raised US$200,000 in seed funding from Singapore-based investors10.

Large traditional media 7Day entered the market in collaboration with Swiss media giant Ringier, launching Duwun Media in late 201511. Print entertainment Journals, such as 8Days and Popular Journal, also transitioned to online publishing. Local film and production giant, Media 7 acquired a celebrity focused Facebook page with over 8 millions followers and rebranded it as Cele7 in 201712.

Foreign tech startup, Mediaload from Cambodia, started Myanmarload to grab a share of the pie in 201613, armed with the seed fund from 500 Startups, a global venture capital seed fund headquartered in Silicon Valley.

The stage was set for a fight to grab the fleeing attention of Myanmar internet users.

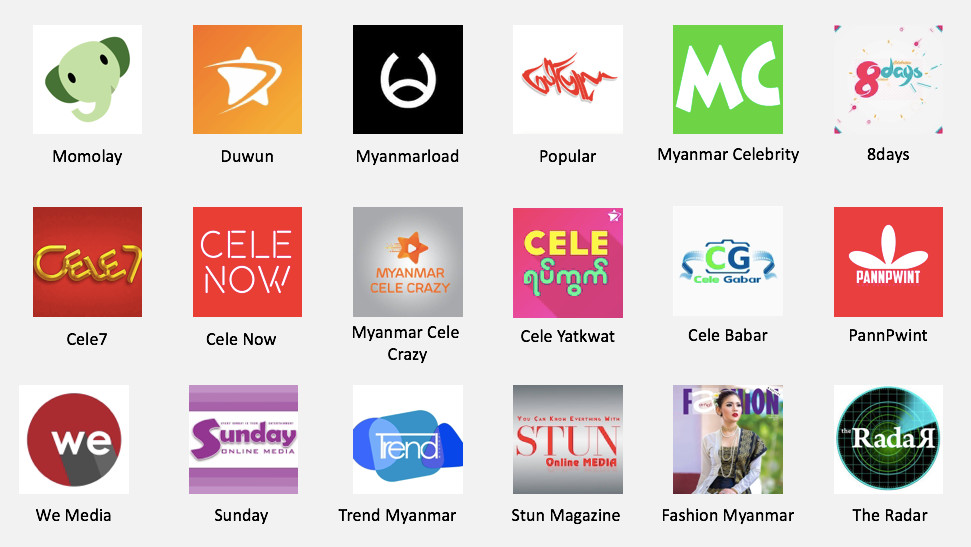

List of notable online entertainment media in Myanmar in 2019

Monetizing Online Content

As the popularity and readership grows, monetization has become the main challenge for online media. Almost all online entertainment media favour advertisement model over subscription model. Free online content is a norm and subscription model fast becomes a sure way to turn away readers.

Facebook Audience Network

Since Google Adsense does not support Myanmar language14, most online entertainment media adopt Facebook Instant Article and rely on Audience Network for revenue. Like most ads networks, Audience Network uses Cost per 1000 impressions (CPM) model15, where media are paid for the number of ads impressions shown on their content. The estimated CPM on Audience Network for Myanmar hovers around 0.10 USD16. In comparison, estimated CPM for Thailand and Singapore average 0.37 USD and 1.28 USD respectively. Although local ads networks, such as MyOpenAds and Mogok Ads, provide higher CPM compared to Audience Network, they are not a viable alternative due to their limited ads inventory. MOA, one of the emerging tech startups in Myanmar, has developed a first ever Myanmar content, contextual and user behaviour targeting system but has so far failed to gain traction with advertisers.

Numerous copycat media also sprang to life to capture part of online advertising market. One of the most notorious, Lwinpyin, had millions of followers on Facebook at its peak. These media copied content verbatim from other media and posted on their own websites and pages. The outdated Myanmar copyright law means that their actions cannot be prosecuted under the existing laws. Plagiarized content from these media competes with legitimate content for the ads dollars on Facebook.

All online entertainment media rely on Facebook for reach and revenue. One danger of such reliance is that policy and algorithm changes by Facebook may negatively impact readership and revenue of online entertainment media. Some media have started experimenting with their own mobile applications to reduce reliance on Facebook. The popularity of Facebook however means that such efforts are likely to face uphill tasks.

Pre-roll Video Ads

Most online entertainment media also utilise pre-roll ads in their videos on Facebook. The practice was popularized by Myanmar Celebrity (example video) which started including pre-roll ads in most of their videos in 2016. However, this practice directly runs afoul of Facebook Branded Content policies of "Don't include pre, mid, or post-roll ads in videos or audio content"17. Facebook has not been punishing the offenders so far. Some media, including Momolay, choose not to use pre-roll ads to avoid potential repercussions from the violation.

Sample screenshots of pre-roll ads from Myanmar Celebrity and 8Days

Content Creation and Offline Events

Most media also provide content creation services such as brand video creation, live video coverage on Facebook, and media interviews at commercial events. Some media, such as Duwun, routinely organize offline events such as Duwun Food Carnival for additional revenue.

Popular Content Types

Online entertainment media adjust the content format to cater to their target demographic, which is mostly youth aged between 18 and 34. For example, 83% of Momolay users fall within the 18 - 34 age range. 59% are men and 41% are women. Different media will have slightly different demographics, reflecting their focus areas.

Momolay user demographic as of March 2019

Light Content Format for News Articles

Online media embrace light format with images to create easily digestible content. A random check of 10 published articles during March 2019 from Myanmarload shows an average of 8.8 images and 8.2 lines of text per article. A check on CeleNow, AuntyMay and Shwemom publications also shows a similar trend with an average of 9.8 images and 8 lines of text.

Short Videos

Facebook has started pushing more videos to user newsfeed in 201718. In response, online entertainment media have put more resources into creating video content to ride the wave.

Most videos take the form of 2 - 4 minutes celebrity interviews. Myanmar Celebrity published 26 videos on 31 March 2019 and 17 (76%) of them fall under this category. Similarly, out of 9 videos published by Cele7 during the same period, 8 (88%) videos are short interviews.

Online entertainment media also create specialized video programs which usually take more time and resources. For example, Momolay produces "Youth Stars", which features in depth interviews with young artists usually under 15 years old. Cele Yatkwat produces "Cele Snap", which is a rapid-fire Q&A session with celebrities. These programs tend to have higher organic reach and engagement than short interviews.

What's Next

Online entertainment industry in Myanmar is still in a nascent stage with a long way before reaching a maturity. As technology, user bahaviour and competitive landscape change, online entertianment media startups need to reinvent themselves to stay relevant.

More Videos, YouTube and Live Streaming

With fast internet speed and falling data prices, users have started consuming data-heavy content such as videos19. Along with more video consumption on Facebook, YouTube has also started gaining traction and has become a viable alternative to Facebook for online entertainment media and users in Myanmar. Myanmar Celebrity Youtube channel has more than 480,000 subscribers in March 2019. Although it is a far cry from 7 millions followers that Myanmar Celebrity has on Facebook, it is a marked improvement from just a year ago. This is also in line with the global trend of increasing consumption of video content with YouTube hitting more than 1 billion hours of daily watch time in 201820.

Live streaming is also on the rise with viewers prefering to take part in the process instead of consuming the content passively. For example, 2 minutes live-streaming on Facebook from Sai Sai Kham Leng, a well-known singer and actor in Myanmar, resulted in more than 3,000 live comments. Live streaming of major commercial events have also become a norm, with relatively inexpensive portable video streaming devices, such as Sling Studio, making the process easier.

Screenshot of Sai Sai Kham Leng's live video on Facebook

High Frequency Quality Content

Advancement in video recording and editing technology makes it easy to create compelling content, further lowering the barrier to entry. The line between brands and media has also blurred in recent years with brands creating their own contents to directly reach out customers on Facebook. To fend off direct and indirect competition, online entertainment media need to invest in the infrastructure, network and operational process to continuously produce high frequency quality content.

Technology in Operation and Distribution

As competition heats up, it becomes increasingly important for online entertainment media to utilize technology to gain an edge over others. One interesting area is the use of Natural Language Processing (NLP) for understanding news content to gain insight on trends and user interest. While NLP for popular languages, such as English, is well developed and widely used in the industry, the research for Myanmar langauge NLP is relatively young and industrial applications are still almost non-existent.

Chatbots will also become important in news distribution21 as they make personalisation of news content possible without having to build seperate mobile applications. Services, such as Chatfuel and ExpaAi, make it easier to build chatbots. Online entertainment media may also use rich media and mini games through chatbots in creative ways to increase engagement.

Most online entertainment media are unfamiliar with cutting-edge technologies and may not have necessary resources to invest in research and development. However, it will be a competitive advantage for those who can utilize these technologies.

Business Model Innovation

There is also a legitimate debate for online entertainment media to expand from their core function of creating content. TMZ, a tabloid news website, organizes TMZ Celebrity Tour, which is a bus tour of Hollywood. Branded merchandising is also something to consider with Barstool Sports, a digital sports publisher from US, generating 30% of their revenue from the sale of branded merchandise22. Organizing live events and ticketing may also be an option. The challenge will be to balance the available resources between the core function of content creation and experimentation for new revenue streams, developing additional core competencies along the way. While digital ads marketing is still growing in Myanmar, online entertainment media will do well to consider alternative revenue streams to reduce the risk of the race to the bottom.

Cautiously Optimistic Outlook for Online Entertainment Media Startups

Momolay Website Pageviews from 2015 to 2018

There is no indication of stopping for the growth of online entertainment media in the near future with internet penetration expected to grow further23. Myanmar is also projected to be one of the fastest growing ads markets with estimated 18% annual growth24. The growing trend of advertising budget shifting towards online platforms is also promising.

However, online entertainment media startups are cautiously aware of their reliance on Facebook for reach and revenue. Low barrier to entry also means that potential profits may be eaten away by new entrants and more competition. News aggregators, such as Zalo News, working with copycat media, also pose a threat to the livelihood of legitimate media.

Like any media in today digital world, online entertainment media startups in Myanmar need to be nimble and avoid potential pitfalls to stay on course for continuous growth and profit.

Sources

[1] Low Cost Mobile SIM Card Offer in Myanmar

[2] Waiting for the SIM card price drop ~ Chris Myers, The Myanmar Times

[3] Myanmar cuts the price of a SIM card by 99% ~ Sam Petulla, Quartz

[4] Ooredoo and Telenor get licences ~ Philip Heijmans and Aung Kyaw Nyunt, The Myanmar Times

[5] MPT Undergoes Rebranding in The Face of Competition ~ Htun Thun Min, Myanmar Business Today

[6] China's Huawei sees strong smartphone growth in southeast Asia ~ Reuters

[7] Digital, Social & Mobile in Southeast Asia in 2015 ~ We Are Social

[8] Digital in 2018 in Southeast Asia ~ We Are Social

[9] Facebook Free Basics lands in Myanmar ~ Catherine Trautwein, The Myanmar Times

[10] Momolay wants to take on Facebook in Myanmar, bags funding to take a shot at it ~ Judith Balea, Tech In Asia

[11] Ringier Asia launches online platform Duwun in Myanmar

[12] Media 7 acquire Myanmar Celebrities, a story behind the Facebook page sales ~ Kyaw Ko Ko, Duwun Media

[13] Khmerload: First Cambodian Startup to Receive Silicon Valley Investment ~ Cheyenne Chia, Geeks In Cambodia

[14] Languages AdSense supports

[16] Estimated CPM rates are based on the rates Momolay fetched from Facebook Audience Networking, based on geological locations during Jan and Feb 2019.

[17] Facebook Branded Content Policies

[18] Facebook to use its News Feed to push more videos to users ~ David Ingram, Reuters

[19] Mobile Video Preferences in Myanmar - Highlights

[20] YouTube Revenue and Usage Statistics (2018)

[21] Chatbots as a Distribution Strategy for Media Companies

[22] The Revenue Stream Revolution in Entertainment and Media

[23] Upgrading Myanmar’s internet access ~ Basheerhamad Shadrach, The Myanmar Times